Costs of long-term investments — benefits expected to last longer than one year. If you want to solve these challenges, you need to have full visibility into your operating costs as a bare minimum. Upfront cost – You pay for them in advance — before using them. Most CapEx projects are one-time investments, only requiring updates, upgrades, or replacements every five to ten years.

CapEx is reported on the balance sheet as a capitalized asset. Most CapEx assets are depreciated over their useful life; in this manner, an expense related to the asset is recognized each year evenly over its useful life. These 14 cloud cost management tools help optimize costs and eliminate needless overhead on your cloud bill. On-premises – Most CapEx spend is often for physical, fixed assets that you will install, run, and maintain on-premises or within a physical data center.

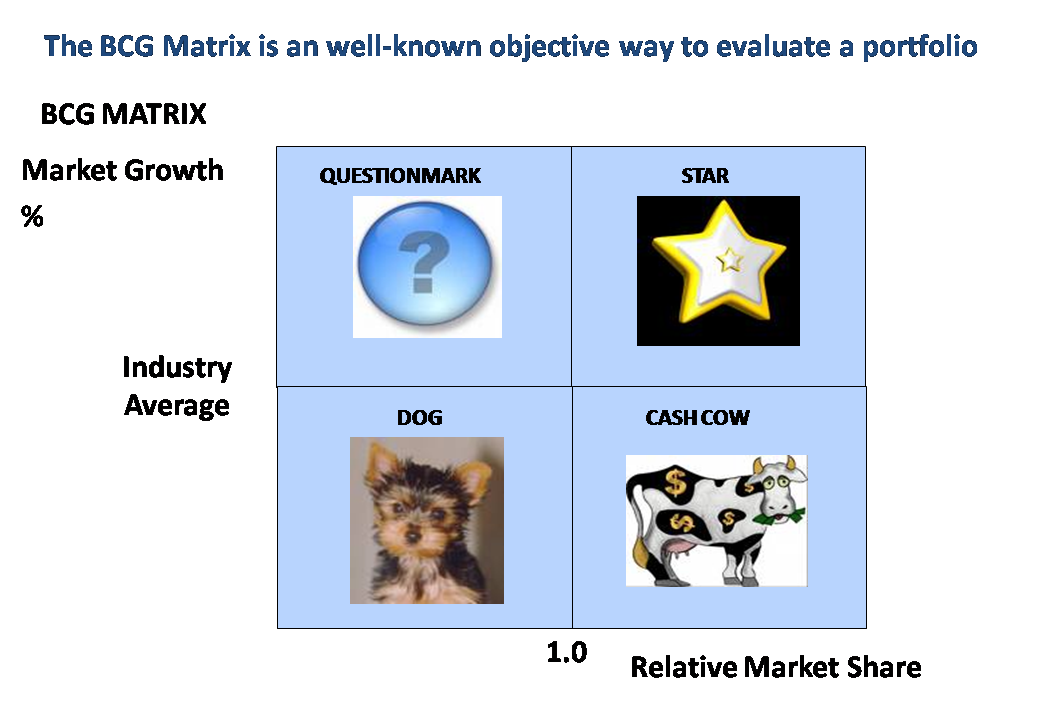

CapEx, or capital expenditure, refers to one-time upfront costs incurred for assets that will be used in the future. A capital purchase shows up in the company balance sheet and depreciates in value over its lifetime. The business expects to derive value from the asset for a period of time longer than a single tax year. One way is to divide them up into different categories—the most common of which are capital expenditures and operating expenses . Capital expenditures are major purchases that a company makes, which are used over the long term. Operating expenses, on the other hand, are the day-to-day expenses that a company incurs to keep its business running.

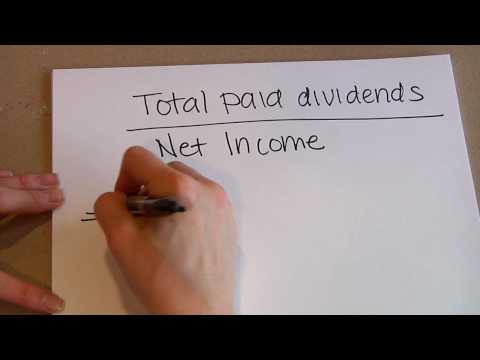

For example, the building of a new warehouse may result in 1,000 transactions over a six-month period, all of which are collectively considered CapEx. The difference between these two expenditures lies primarily in the accounting treatment of each. For business in the United States, generally accepted accounting principles often dictate how an expenditure is treated on a company’s financial statements. Therefore, a company must understand the long-term financial implications of how its reporting will be affected and how external parties may view the company’s health as a result. Capital expenditures cannot be deducted from income for tax purposes, but operating expenses are eligible.

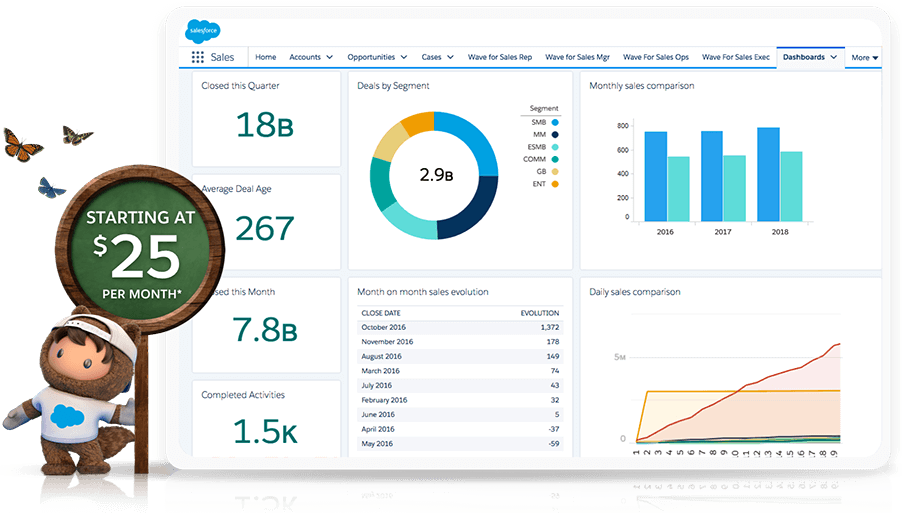

That’s why many companies prefer the OpEx model over the CapEx model for improved business agility, lower upfront costs and reduced management costs. Understanding the difference between operating expenses and capital expenditures will help you decide when to go either way. For example, SaaS companies that overreport COGS weaken their margins, which deters investors and hinders growth funding. Capital expenditures or CAPEX refers to the major purchases that a company makes.

This will make sure you do not miss out on the benefits from tax-deductible expenses. Additionally, it will keep track of all your expenses and keep your financial statements and financial KPIs updated in real-time. It is essential for every firm to identify its operational activities, primary revenue-producing activities, and other non-financing activities before calculating its operating expenses. These types of expenses are generally shown on the income statement of an organization. Operating expenses are deducted from the gross profits of the company when they occur. These are cash expenditures incurred to expand or increase the efficiency of the existing capital assets.

Hardware Costs for SaaS Projects

Operating expenses are important to an organization as they help assess the firm’s cost and stock management efficiency. These costs or expenses do not relate to the production of a product. It highlights the level of cost that is required for a company to generate revenue. A relatively higher OPEX indicates that the company is less efficient.

- Capital expenditures are listed on the balance sheet under the PP&E section.

- Increasingly, cloud environments can predict or limit—often automatically—these costs.

- You pay for a service or product as you use it i.e. pay-as-you-go pricing.

- To increase capital investment, businesses take loans, issue bonds, or use other debt instruments.

Choosing whether to set up an on-prem data center or outsource a virtual data center . CapEx requires precise forecasting and budgeting due to the high risk of losing money. CloudZero is the only solution that enables you to allocate 100% of your spend in hours — so you can align everyone around cost dimensions that matter to your business. Pinpoint the cost of supporting a specific customer or product feature, so you can tell how to set up pricing to protect your margins.

What IT Expenses Are Included in CapEx?

Long-term – Procured to provide benefits past the current tax year. Many assets, such as buildings, patents, and computers, remain economically viable for decades. By contrast, cloud computing operates on a pay-as-you-go basis, with no upfront payments.

Contrary, operating costs comprise all expenses you spend to run your entire business, not just the revenue-generating activity. The traditional approach prioritizes capital expenditure , whereas cloud economics favors operating expenses . As many companies shift from traditional IT infrastructure to cloud computing, they are also rethinking how they handle cloud costs — from accounting to tax reporting. Capital expenditure is a big investment made by the company, usually for acquiring an asset that would be helpful for the company in the years to come.

Owning assets such as hardware and software may be seen as prestigious. Many organizations specify that all major IT goods or services be purchased, and they cannot be leased or “rented” through an MSP. Purchasing a capital item requires a certain amount of forecasting.

Examples of CAPEX or Capital Expenditures

On the other hand, the entire amount of $150,000 paid to the vendor for the leasing is accounted for as an operating expense as it is a part of the daily business operations. The company can deduct the amount it has spent from the net taxable amount that year. The advantage is that it can be deducted from taxes levied upon the net income in that accounting year. Therefore it is more attractive for a company to lease an item and assign its cost to operating expenses rather than purchase it. Operating expenses are the funds a business allocates recurringly to support day-to-day operations.

Pros and Cons of CAPEX

Capital expenses cannot be deducted from income for tax purposes while operating expenses can be deducted from taxes. CAPEX is listed in the investing activities of a company and is shown in a cash flow statement and OPEX is shown on the income statement of a company. For instance, a sales and marketing campaign is deemed to be near-term spending, since the positive impact on revenue (the “top line”) should occur within the next twelve months. Before the advent of cloud services, companies generally had to either purchase their IT infrastructure assets – a capital expenditure , or lease them – an operational expense . However, with the adoption of Infrastructure as a Service and Software as a Service models, organizations have been able to shift more of their IT spending towards operational expenses . In this blog, we’re going to take a look at why OpEx holds the advantage over CapEx when it comes to IT budgeting.

After reading the above point, you will have realized that both capital expenditure and operation expenditure are important for the survival of the company. For instance, OPEX may be better from a tax perspective, but CAPEX allows a business to increase the size of its balance sheet. Thus, it is very crucial for any business to understand the difference between CAPEX vs OPEX. As many companies shift from traditional hardware and software ownership to as-a-service models, IT and finance departments must reconcile how best to classify cloud costs.

In cloud computing, managed services providers include all costs in a single subscription. The fixed assets purchased are intended to benefit the organization for more than a year. If the useful life of the asset exceeds one year, which is typical, then the cost is expensed using depreciation from three to twenty years after the purchase date. In the case of real estate, the depreciation can be for over twenty years. Often a company borrows from lending institutions to buy assets or make CAPEX.

It is financing used by businesses to secure physical assets or upgrade current assets. Capital expenditures are those funds that a company makes use of to acquire, improve, or maintain its physical assets. Capital expenditure comes in the balance sheet, but the depreciation on fixed assets comes in the income statement.

However, unless you’re talking to the company bookkeepers, most folks won’t notice the difference. Cost relating to the Opex are completely deducted from the gross profit. This is because the use of a product/ service has happened in the current financial year and shall be of benefit to the firm only in the current year. Therefore, neither these costs are spread across years, nor are they carry forward to the next financial year.

Each industry might have different types of capital expenditures. The purchased item might be for the expansion of the business, updating older equipment, or expanding the useful life of an existing fixed asset. Capital expenditures are listed on the balance capex vs opex sheet under the PP&E section. CapEx is also listed in the investing activities section of the cash flow statement. Operational expenditures are generally tax deductible, provided they are “ordinary and customary costs” to keep the business running.